- Mandy's World

- Posts

- Monday, 3rd July 2023

Monday, 3rd July 2023

Unveiling Insights: The Fifth Crypto Cycle, Fiscal Dominance, and More

Monday, 3rd July 2023

Introduction

Welcome! In this edition, we focus on Hartmann Capital's analysis of the Fifth Crypto Cycle, exploring regulatory challenges and key court cases. We also delve into Lyn Alden's newsletter on fiscal dominance, discussing the relationship between interest rates and inflation. Enjoy the music playlist, learn about the Toothbrush Test, and ponder some random thoughts. Let's dive in and expand our knowledge together!

What I read today:

Hartmann Capital’s Newsletter and my notes on it:

What you as an investor can learn from this information from Hartmann Capital Research, we have summarized here for you in a structured way:

Introduction:

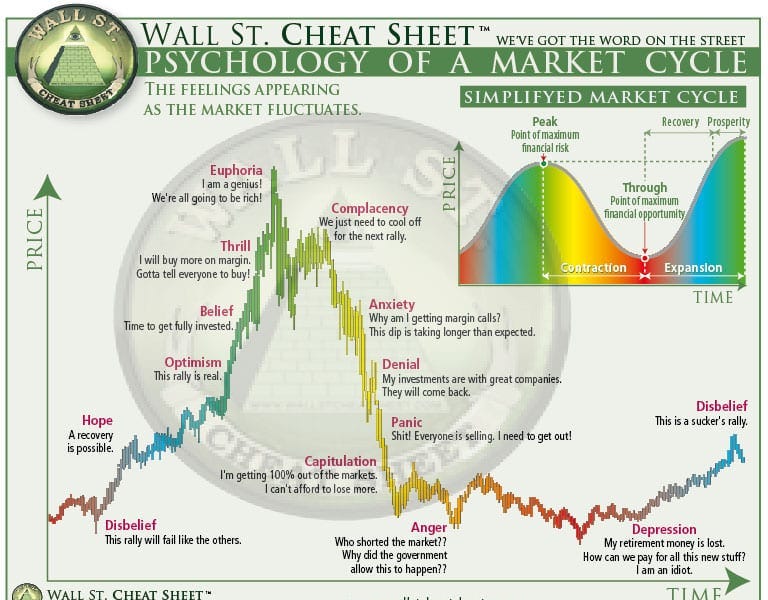

- The market cycles for digital assets are consistent with previous cycles.

- Bitcoin is likely to lead the new cycle, as in previous cycles.

Regulatory Outlook:

- There are currently regulatory challenges and investigations in the industry.

- Clarification of regulatory issues could provide clarity and accelerate capital formation and innovation.

Key court cases:

- SEC v. Coinbase: the outcome will provide clarity on the classification of digital assets as securities, the structure of digital asset exchanges, and the treatment of staking and stablecoin products.

- Grayscale v. SEC: The outcome will determine the treatment of futures-based and spot-based bitcoin ETFs and address potential disparate treatment of related products.

Infrastructure Improvement:

- Assess whether the infrastructure supporting digital assets has improved since the last cycle.

Successful Opportunities:

- Identify key opportunities that have successfully leveraged digital assets, such as DeFi, stablecoins, NFTs, the metaverse, and decentralized web infrastructure.

Market Bottom:

- Evaluate whether the market has bottomed and determine potential entry points based on market dynamics.

Aaand, Lyn Alden’s Newsletter is always a good read! Read my notes below:

Fiscal Dominance - Notes on Lyn Alden's Newsletter - July 2023:

1. fiscal dominance: the newsletter explores the concept of fiscal dominance and highlights the relationship between interest rates and consumer price inflation.

2. challenging investment environment: 2022 was a challenging year for investors, with the Federal Reserve tightening monetary policy, stock and bond prices falling, and negative economic indicators pointing to a possible recession.

3. government deficits and debt: The U.S. government budget deficit began to grow again as a percentage of GDP, indicating increased fiscal spending. It is unusual for the deficit to reach 8% of GDP while the unemployment rate is below 4%.

4. causes of inflation: the newsletter explains that two main causes of inflation are rapid bank lending and large currency deficits related to conflict or demographic factors.

5. Historical examples: Historical periods such as the 1970s (rapid bank lending) and the 1940s (large deficits due to wars) illustrate different causes of inflation and the corresponding policy responses.

6 The challenge for the Federal Reserve: The Federal Reserve's policy tools are primarily designed to address credit-induced inflation rather than deficit inflation. This poses challenges in addressing the current situation of high deficits.

7. Impact of interest rates: Raising interest rates can increase government interest expenditures, potentially worsening deficits and limiting the effectiveness of interest rate increases as a tool to combat inflation.

8. debt burden and interest spending: The newsletter highlights the potential impact of higher interest rates on U.S. federal debt and illustrates the substantial increase in interest spending even with a small increase in interest rates.

9. inflationary forces: the analysis considers the interplay of various forces, including the disinflationary effects of tighter monetary policy on some sectors versus the inflationary effects of higher deficits.

10. Spending Trends: The spending propensities of different income groups can affect the inflationary impact of deficit spending, with lower-income individuals having higher spending propensities.

What I saw today:

Also watched the latest episode of HBO’s “The Idol”!

What I listened to today:

Good music…

What I liked today:

Turns out no one wants to buy $10,000 internet pictures...

Will NFTs ever return

— Alex❓ (@ShiLLin_ViLLian)

1:19 PM • Jul 2, 2023

What I learned today:

The Toothbrush Test

When Larry Page (Google Founder) looks at companies - he uses "The Toothbrush

Test"

Will somebody use it twice per day?

E.g. Google, YouTube, Google Calendar, and Gmail all follow the Toothbrush test.

Larry Page, the CEO of Alphabet (the company formerly known as Google), has an interesting way of deciding which companies he likes or doesn’t. It's called "The Toothbrush Test”.

According to the New York Times, when Page looks at a potential company to acquire, he wants to know if the product is, like a toothbrush, "something you will use once or twice a day."

Random Thoughts:

You reach a beautiful level of freedom when you can be alone without feeling lonely.

That’s it for today! ☺️

Reply