- Mandy's World

- Posts

- Shifting Tides: Credit Ratings, Investments, Empathy, and the Digital Realm

Shifting Tides: Credit Ratings, Investments, Empathy, and the Digital Realm

Exploring Key Insights Shaping Today's World and Tomorrow's Choices

Shifting Tides: Credit Ratings, Investments, Empathy, and the Digital Realm

Introduction

In today's rapidly evolving landscape, where economic shifts intersect with social dynamics and digital transformation, staying informed and adaptable is more crucial than ever. Join us as we delve into diverse realms, from the economic repercussions of a changing credit rating to the art of investment diversification, the intricate web of empathy and group identity, and the thought-provoking reflections on our ever-expanding digital existence.

What I read today:

Here are my notes on it:

Macro Insights: US Losing Triple-A Rating

The US has lost its Triple-A rating after a Fitch downgrade, leaving only Moody's with the highest credit rating among major agencies.

The downgrade is not a surprise, considering the trajectory of the US debt-to-GDP ratio and rising interest rates.

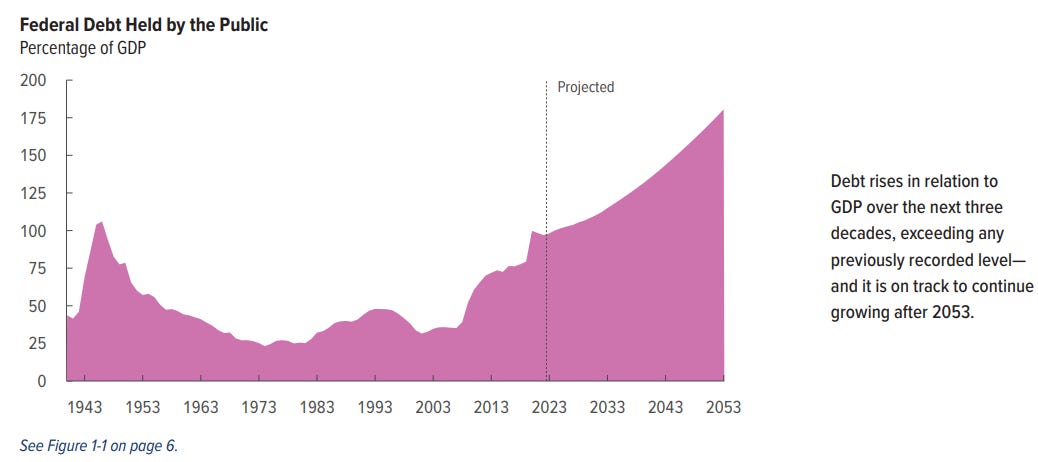

The US debt-to-GDP ratio is projected to increase from 100% to 181% by 2053, with a budget deficit rising from 6% to over 10% in 2053.

The downgrade led to increased long-term interest rates and highlights the sustainability challenge of global debt burden.

Consequences and Investment Implications:

US Treasury market's 'safe-haven' status remains due to its size and liquidity, but the downgrade has led to higher interest rates.

The downgrade underscores the issue of global debt sustainability, emphasizing the need for inflation and low-interest rates for debt maintenance.

Investment approach includes diversification into real estate, commodities, inflation-linked bonds, gold, and Bitcoin alongside traditional assets.

SLOOS Insights (Federal Reserve Loan Survey):

Negative bank lending growth based on the last six months, with year-on-year numbers expected to follow suit.

Slow or negative GDP growth, potentially reaching -2.5% year-on-year to align with lending conditions.

Anticipated spike in high-yield defaults, with historical lending condition relationships suggesting a quintupling compared to 2022.

Divergence between low high-yield spreads and tighter lending standards, reflecting a disconnect from reality.

US ISM Manufacturing Index remains low (46.4), signaling a negative outlook for equity markets.

Market Scenario Analysis:

ISM-Implied Returns scenario analysis indicates downside risk for stocks in all regions.

Positive but diminishing upside for US Treasuries, suggesting caution for equity markets.

Potential repeat of 2022's market conditions, indicating uncertainty for stocks.

Underweight position in Emerging Market Equities, Global Real Estate, and Global High Yield Bonds.

Preparedness to reduce Developed Market Equities exposure if sentiment shifts from the central bank and earnings optimism.

Conclusion:

The US losing its Triple-A rating has implications for interest rates and global debt sustainability.

The investment approach involves diversification into various assets, including traditional and alternative classes.

The Federal Reserve Loan Survey suggests negative loan growth, slow GDP growth, and a potential spike in high-yield defaults.

The ISM Manufacturing Index remains low, indicating a negative signal for equity markets.

The scenario analysis suggests potential downside risk for stocks and cautions about equity market exposure.

Here are my notes on it:

Selective empathy: People often show more empathy for people or groups that are similar to them or belong to their "in-group."

Grouping: our brains tend to group people based on small commonalities or similarities.

Nationalism and identity: nationalism can cause us to have empathy mainly for members of our own nation and show less empathy towards others.

Football fans as an example: soccer fans show how strongly group identity influences our empathy. Empathy is enhanced for one's own "in-group".

Dynamic group identity: our identity is diverse and can change since context. The definition of "in-group" and "out-group" is not fixed.

Positive encounters and empathy: Positive interactions between different groups can foster empathy and break down group boundaries.

Shared goals: Shared goals and experiences can bring people of different groups closer together and expand empathy.

Conscious reflection: it is important to be aware of how selective empathy and group identity affect our behavior in order to overcome prejudice and develop empathy for a broader range of people.

Critical Consideration: Nationalistic and segregative ideologies can cause us to limit empathy for certain groups. An open and inclusive mindset can foster empathy.

Empathy as a way to resolve conflict: expanding our empathy can help reduce conflict between different groups and promote a cooperative society.

What I saw today:

What I listened to today:

What I liked today:

Ever wondered what caused $BALD's 100x initial rally? Mostly a fresh launch on a new chain (Base).

Remember Solana, Arbitrum, and zkSync summers?

What's on the horizon - Mantle, Base, Starknet?

Follow the liquidity flow with my newly designed Dune dashboard.

Let's explore 🧵

— Crypto Koryo (@CryptoKoryo)

10:30 AM • Aug 2, 2023

Global Crypto News 🌐

August 5, 2023 - by @bouncyshii- Telecoin Crypto Scam

- SEC sues Richard Heart, founder of $PLS & $HEX, for $1B crypto fraud.

- Digital Ruble approved by PutinFull article 👉 httpeureka.haus/global-crypto-…p

— Eureka (💡,💡) (@eurekahaus)

6:30 PM • Aug 5, 2023

What I learned today:

Secular trends are long-term, persistent changes or patterns in a particular field or industry. They can be observed over a period of several years or even decades and often have a significant impact on various aspects of life or business.

An example of a secular trend might be demographic change, where the age structure of a population changes over an extended period of time. This can have an impact on the labor market, pension systems, consumption, and other areas.

In the technology industry, secular trends could include the rise of the Internet, the proliferation of mobile devices, or the development of artificial intelligence. Such trends often have far-reaching effects on companies, industries and society as a whole.

Random Thoughts:

When I look at what our world currently looks like, I wonder if we haven't long since landed in a time when virtual connections have become the norm. It feels weird, almost negative. But that's the direction we're going, isn't it? Will it ever change?

Sometimes I think maybe there will come a day when even big stars and influencers realize that being online all the time and sharing through filters just isn't real. The biggest influencers might feel it, that this digital world is somehow foreign, even to them.

But wait a minute, if we all stopped sharing online, how would new trends emerge? Sure, it might spread in little bubbles, like local hype, but globally? That would be harder. And then there's the revenue thing. If no one posts anymore, then there's less money flowing through advertising. That's a factor we can't overlook.

Realistically, it's hard to imagine us going back to the analog world. Is it? After all, we're racing toward a digital future right now, with no brakes. And then, what about real presence? With the here and now?

Can it really be normal if we only connect through screens? I mean, what about face-to-face interaction? There's something to be said for that. But who knows, maybe the day will come when we get used to it. Maybe this new normal won't be as bad as it feels now.

Ultimately, I think our understanding of "normalcy" has quite a bit to do with our satisfaction with the new reality. Maybe we'll get used to it, or maybe we won't. Who can say for sure? But one thing is for sure: I'll keep thinking about it as I immerse myself in this increasingly virtual world. And who knows, maybe I'll find my way to connect the digital and real worlds after all.

That’s it for today! ☺️

Reply